Introduction - Why Gamma?

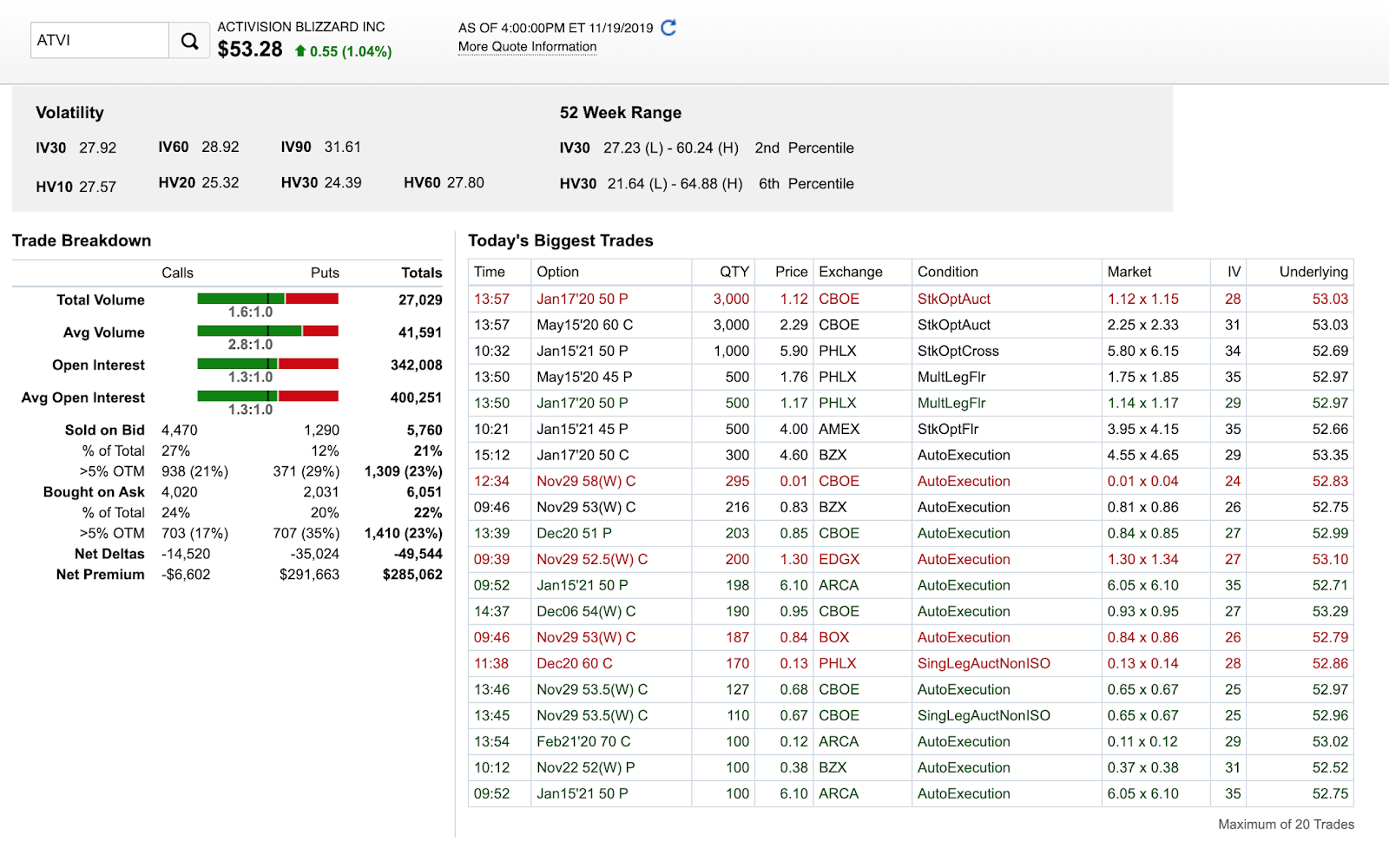

A recent trend within trading platforms is to include detailed and well visualized information

about each day’s option trading activity. Most brokers today (2019) include not only an asset’s

option chain but information about the biggest trades that occured on the chain and overall

impressions of option investor’s exposure. This includes things like Put/Call ratio, Net Deltas,

Net Premium, etc. An example of this summary can be seen below.

While investors become more knowledgeable about options and explore this data, a wide

variety of trading strategies have emerged. Many have speculated about following big fish

taking aggressive improbable bets, using the underlying’s Put/Call ratio as a leading directional

indicator, or a variety of other strategies based entirely on the activity of an asset’s derivatives

and not the underlying asset itself.

As time has passed, CBOE has released tools for investors to better understand the role of

equity derivatives and their effect on the market. ‘The VIX’ is a primary example of an index

derived solely from the information on the SPX option chain. Since its release the VIX has gone

on to have its own set of options as well as futures allowing investors to bet on the implied

volatility of the S&P 500.

This is ballooning now to the point where the average retail investor can buy a contract which is

a derivative of an ETF which holds derivative futures of an index which is itself derived by the

pricing of the derivatives of an index made up of the broader US equity market. I’m always

baffled that VXX options are actually honoured by the market and not completely worthless.

The success of the VIX has lead the CBOE to deliver similar indices derived the same way, on

mega caps and corporations that make up the largest pieces of the S&P 500. (AAPL, GOOGL,

AMZN, etc.)

The reality of the VIX is that it is determined based on the current market spreads for SPX

options. Such spreads are currently being set by dealers and market makers who are monetarily

incentivized by exchanges to fill as many orders as possible. In theory this leads to dealers

competing to make the tightest spreads, giving the best liquidity to discretionary traders. One

potential pitfall is that the collective of market makers may now dictate (to a certain degree)

the movement of the VIX index.

It is not impossible to conceive that every trade made on the SPX option chain is filled by a

dealer. Under four assumptions, an indicator similar to the VIX can be produced. It will attempt

to predict how exposed the liquidity providers books to the movements of the market.

This indicator, known by the few who use it as “Gamma Exposure Index (GEX)”, attempts to

condense the positioning of market dealers down to a single number. Most examples of this

indicator denominate GEX in dollars or shares. It is further assumed that GEX is the number of

shares or dollars the dealers have at risk on any given day. Notable changes in the behaviour of

the underlying asset occurs when the number of shares approaches or exceeds the average

daily trading volume of the asset.

Further information about this phenomenon can be found in the SqueezeMetrics white paper,

or on the Spot Gamma website. Finally, for those of us who don’t care about the integrity of our

sources, Seeking Alpha has had authors discussing market gamma exposure for sometime now.

Additional reading into a common option strategy known as “Gamma Scalping” is also useful

background knowledge.

SqueezeMetrics

One subscription service (Squeeze Metrics) has been providing investors with their own GEX

data since 2017. Recently(Q2 2019) a secondary service, Spot Gamma, with a slightly different

derivation process has also sprouted onto the scene. It is widely known that wealth

management firms release “Gamma Reports” to their clients.

While SqueezeMetrics keeps their signal behind a paywall of 200-1000$/month, they do release

all historical data for free. They also have a very plain website with adequate security. While I

couldn’t fudge my way into a subscription I was able to discover a hidden file on their site. An

unpublished white paper from 2017, when they first released their GEX(tm) index. In this white

paper they outline the major assumptions they make and the equations they use to derive GEX.

I am unsure as to why they do not make the white paper publicly available, or at least more

accessible. Below I have explored their historical data and its ability to produce excess returns

when used as a leading indicator for the S&P 500.

SqueezeMetrics GEX indicator is a single number and does not vary based on option expiry.

Spot Gamma’s indicator is primarily for the next expiry on the S&P 500 chain, and includes price

levels for where the dealers exposure turns negative (more on this later), and which strikes are

likely to act as pins moving into expiry (Max Pain theory). Spot Gamma keeps their entire

process proprietary. They do however, release their historical data and are explicit about what

input data is required for the derivation of their results.

Spot Gamma

Spot Gamma’s website is wordpress which made crawling their directories fairly straight

forward. It was clear that they use the same server to host their model’s data as they do to host

their website. Unfortunately, they were smart enough to keep the model out of reach. (To me,

at least.) I was able to uncover a couple intermediary data tables as well as access to their

subscription data. In reality, I should just pay them the 20$/month considering I stole their

model.

Using both the historical input data and its results, I was able to reverse engineer their model.

This process involved a Random Forest Recurrent Neural Network. This process is fairly simple

in actuality. If I know; bananas, yogurt and strawberries go in and a smoothie comes out, the

neural network can turn itself into a blender with relative ease. Computers are really good at

math.

While the model is only able to reproduce Spot Gamma’s numbers within a 0.05% margin of

error, that is well within an acceptable level of confidence. I am currently allowing the model to

improve itself day over day with unsupervised learning and by validating its results against what

is published by Spot Gamma for subscribers. Again, they deserve my 20$/month.

Why Will It Break?

In both cases, Spot and Squeeze, there exists four primary assumptions. The pitfalls of this

strategy may be exploited here. As outlined in their white paper, Squeeze assumes that every

trade is facilitated by a market maker. They further assume that call options are SOLD by

investors and are BOT by market makers. This means that the makers are short for every open

call contract. Subsequently, the inverse is assumed to be true for puts. The final assumption is

that marmet makers want to have a completely delta neutral book. Market makers intend to

sell theta premiums and are looking to remain neutral to the movement of the underlying

asset.

While this market microstructure should exist in any optionable asset that has market makers

providing the liquidity, we will only explore the SPX. Attempts to reproduce these results on

canadian equities has been mixed.

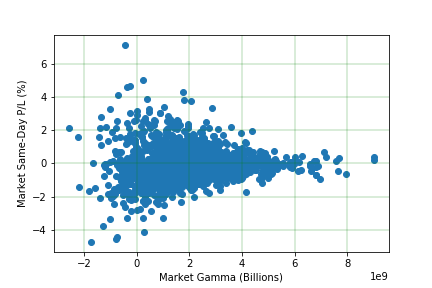

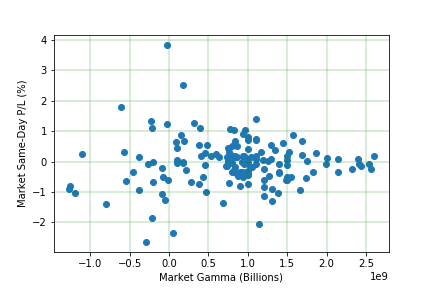

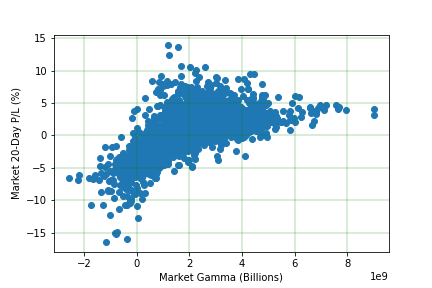

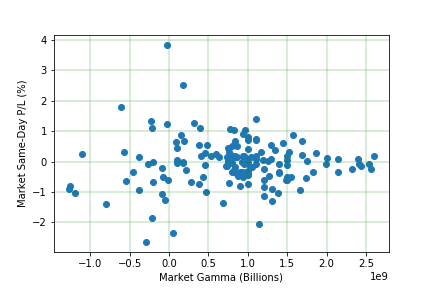

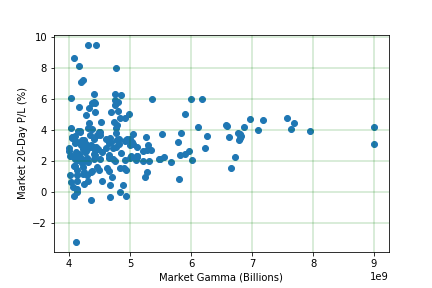

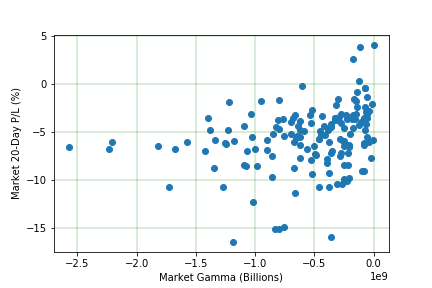

SqueezeMetrics data goes back to 2004, allowing for a far more insightful picture into the effect

of dealer exposure to the market compared to the 6 months of Spot Gamma data. We may

begin by evaluating the market same-day returns against the market gamma exposure (GEX).

While the returns of the SPX are fairly well distributed two trends are apparent. Volatility, in

terms of absolute movement, is heavily stifled when market gamma reaches positive extremes.

What’s more, is that the largest intraday moves occur when market gamma exposure is

negative.

Negative Gamma Exposure?

When the GEX is measuring positive numbers, it is suggesting that dealers hedge by trading the

underlying, they are taking trades that go AGAINST the movement of the asset. For example, if

the GEX is >4bn then the makers will sell as the asset rises and buy as the asset declines. When

GEX is negative or < 0, makers will sell into weakness and buy into strength. This phenomenon

may explain why the largest moves occur when the makers are negatively exposed. Their

trading activity exemplifies the movement already occurring as opposed to counteracting it.

Observant readers will already be foaming at the mouth for an opportunity to trade this

statistical advantage, but we shall continue to explore the data in an attempt to better our

understanding of this signal and produce a trading strategy that may produce excess returns.

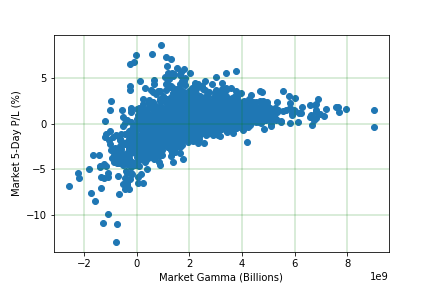

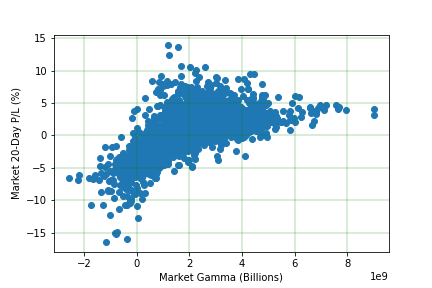

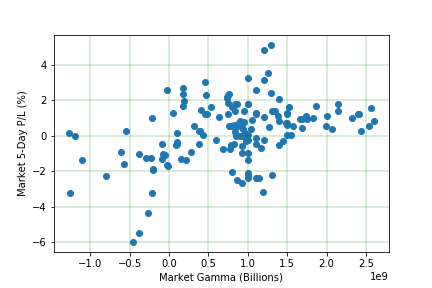

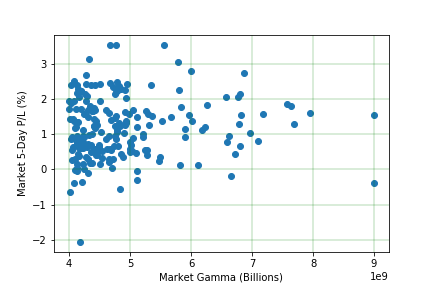

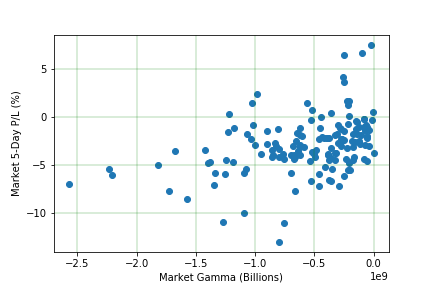

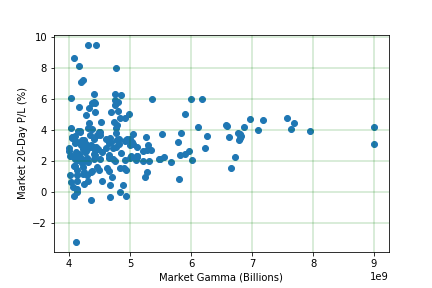

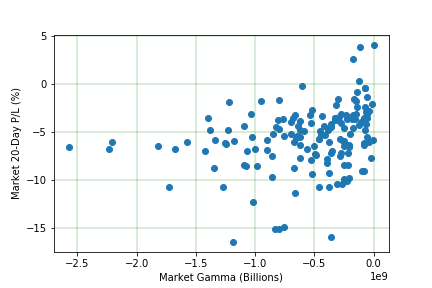

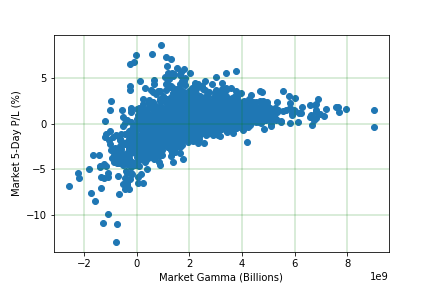

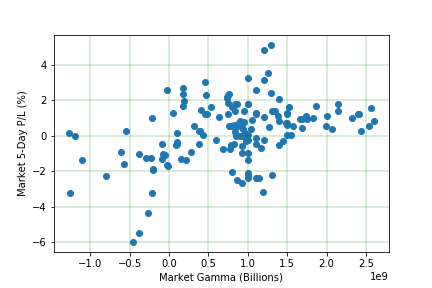

The following shows market’s 5-day and 20-day returns against the SqueezeMetrics GEX signal.

Figure 3: 5-Day market returns vs GEX opening print.

Figure 4: 20-Day market returns vs GEX opening print.

For posterity, the same three figures have been produced by the Spot Gamma Machine

Learning model.

Figure 5: Same-Day market returns vs SPOT opening print.

Figure 6: 5-Day market returns vs SPOT opening print.

A quick review of these plots make the trend abundantly clear. When market makers have

money on the line, they destroy volatility. When market makers benefit from movement, they help

push the index around. In either case, the hedging activities of market dealers clearly impacts

the returns of the market.

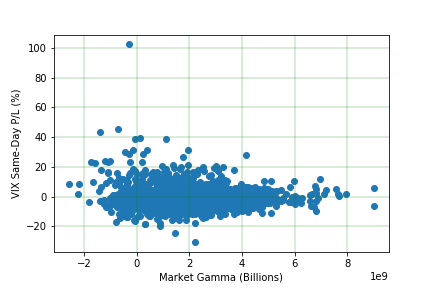

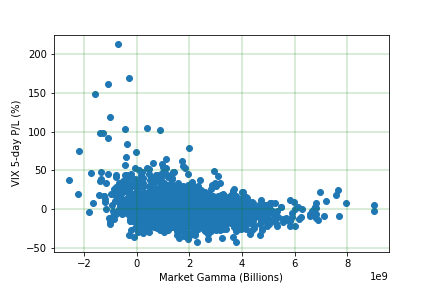

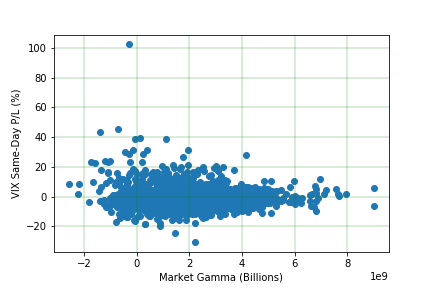

Earlier in this report we discussed the possibility that market makers control every print of the

VIX. Before exploring the use of GEX as a trading signal, it felt worthwhile to evaluate the VIX’s

performance alongside the GEX signal. Our assumption is that dealers will tank the VIX index

when they have large amounts of money at risk.

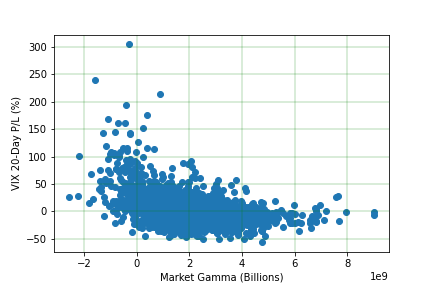

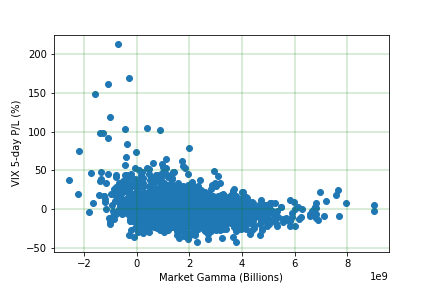

Figure 8: Same-Day VIX returns vs GEX opening print.

Figure 9: 5-Day VIX returns vs GEX opening print.

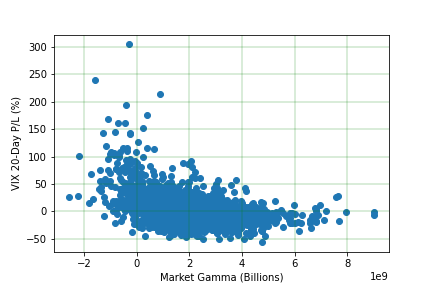

Figure 10: 20-Day VIX returns vs GEX opening print.

Using the above charts it can be concluded that our GEX model of maker positioning has some

correlation to the VIX index. So now the question must be asked, is this simply a case of the tail

wagging the dog? What if we’ve simply fit the data and the four assumptions are false?

I don’t need to know why, I need to make money.

Some additional extrapolation from the above figures must be done in order to develop this

signal into a viable trading strategy. Many quantitative investors may seek to optimize against

the data and find the optimal threshold of GEX to fit their desired risk tolerance. I’m quite

happy to draw some lines in the sand and trade around those.

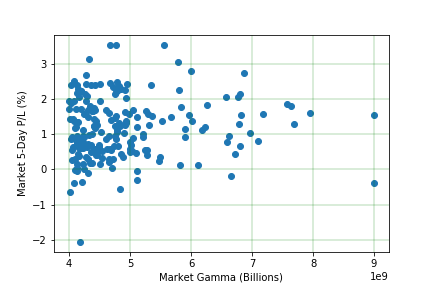

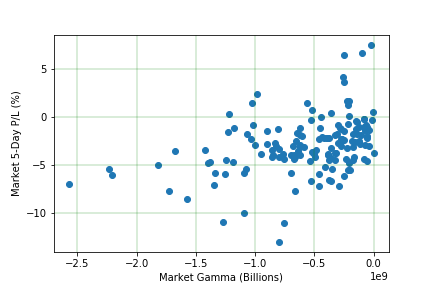

The following data displays the 5-day and 20-day returns for the S&P 500 when market gamma

is above 4bn(Squeeze) or below 0.

Figure 11: 5-day S&P 500 return when market gamma exposure (GEX) is greater than 4bn.

Figure 12: 5-day S&P 500 return when market gamma exposure (GEX) is negative.

Figure 13: 20-day S&P 500 return when market gamma exposure (GEX) is greater than 4bn.

Figure 14: 20-day S&P 500 return when market gamma exposure (GEX) is negative.

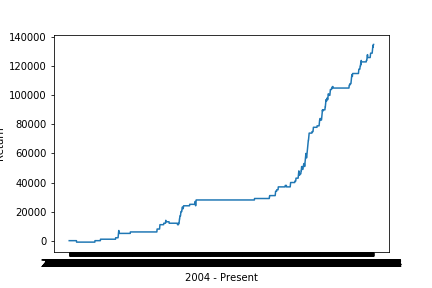

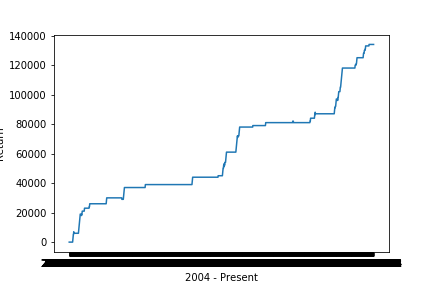

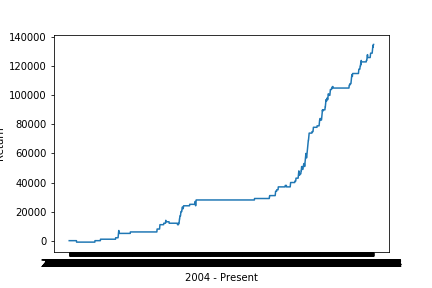

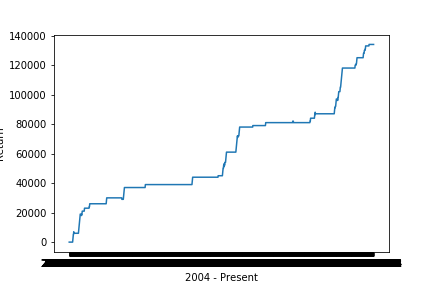

While these trends are impressive, a rudimentary strategy has produced even better numbers.

This is so disgustingly profitable that I worry about putting the ideas in writing. Often times it

feels like signals work right up until the moment the first trade hits the market.

The following result (Figure 16) is from purchasing 6-8 Day-to-Expiry, Nearest To The Money,

Call Options. 1 contract is purchased at the day’s open if the GEX is above 4bn. Options are sold

at +100% gain, otherwise held to expiry.

Figure 15: 6-8 Day-to-Expiry Calls when GEX opened above 4bn.

The following result (Figure 17) is from purchasing 10-12 Day-to-Expiry Straddles. Contracts are

purchased at market open whenever the GEX is negative.

Figure 16: 10-12 Day-to-Expiry Straddles purchased when GEX opened negative.

Aside from the obvious next steps towards making money with this system, there are a few

other avenues that are potentially worth exploring. The first being further correlations to the

VIX index. A combination of VIX and GEX could lead to more meaningful signals allowing the

system to take trades more frequently, hopefully leading to increased returns. Earlier, it was

mentioned that VIX indexes have been produced for mega cap corporations. It would be

worthwhile to evaluate a GEX on those mega cap corporations who could have their liquidity

providers affecting their share price in a similar vein they affect the S&P 500. These listings

include; AAPL, GOOGL, AMZN, GS, IBM. They also have these indices for sector ETFs, Bonds and

Commodities. Should similar trends and results be found market wide, it would suggest that the

GEX truly is a leading indicator and would validate not only the system’s assumptions, but also

it’s results.

Work with individual canadian equities has been done, but the results have been inconclusive.

The most likely reason for this is a lack of liquidity takers (discretionary traders making option

trades) to allow the market makers to build up heavy books. It is clear from the SPX results that

the effects of GEX are most notable and reliable when the books are the heaviest.

The following work still needs to be done in order to bring this system to a live trading

environment. Additional backtesting with exact contract closing prices, and improved

granularity needs to be done. These tests will provide insight on the system’s trading technique,

drawdowns and risk. Once that is complete, a better picture of the system’s methodology and

profitability will be clear. From here, modern portfolio metrics will allow a system to be catered

based on risk tolerances and expected returns. It is notable that no metrics like; Sharpe Ratio,

Max Drawdown, Avg Returns, Value at Risk, Beta, Alpha, Skewness, etc. were included in the

results. Too many assumptions were made in producing a rudimentary backtest that those

metrics would be useless and non-reflective of a live environment.

At present there are no intentions of automating such a system should a profitable one arise

after the necessary research is complete.